Cryptocurrency confusion? Amin Shams to the rescue

The assistant professor of finance breaks down the wild, curious world of blockchain, bitcoin and cryptocurrency’s future.

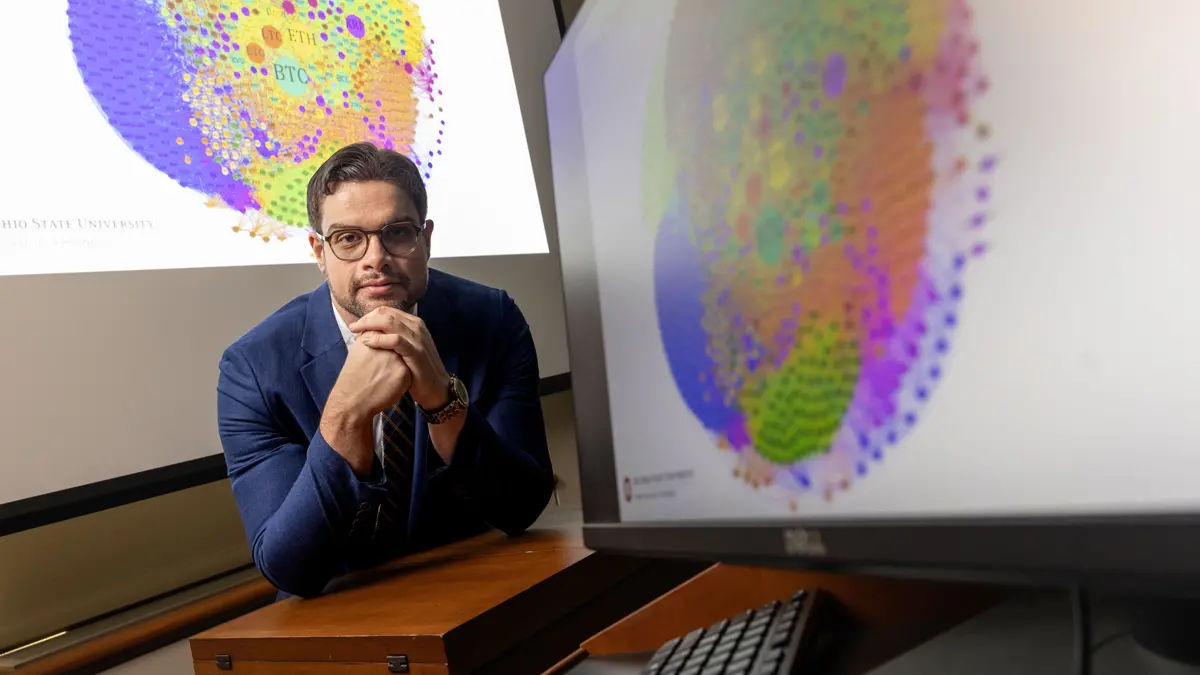

Assistant professor Amin Shams, who has a master’s degree in global policy studies and a PhD in finance, researches and teaches about cryptocurrency. (Photo by Jodi Miller)

More than 10 years after bitcoin rose to mainstream prominence, the world of cryptocurrency is still mysterious to many of us.

As an assistant professor of finance in Ohio State’s Fisher College of Business, Amin Shams spends endless hours researching, uncoiling and explaining the intricate and mushrooming world of cryptocurrency.

Recently, he took your questions related to cryptocurrency and blockchain.

First, he says, it’s important to understand the difference between blockchain technology and cryptocurrencies, such as bitcoin.

Blockchain technology is what enables cryptocurrency. Think of it as a ledger that keeps track of cryptocurrency transactions. Bitcoin, which rose to prominence in 2009, is one of the best-known cryptocurrencies. However, it’s only one of more than 20,000 cryptos out there, which, without blockchain technology, wouldn’t be possible.

“Blockchain technology enables bookkeeping of important and sensitive information,” Shams says. “After the 2008–09 financial crisis, people started developing some distrust of the financial system, major banks and even central governments. People had this dream of decentralizing the financial system, and that was how bitcoin started.”

-

What do you do with cryptocurrency? What are the applications? — Dr. Tracy Leonard ’83, ’87 DVM

Very broadly, we can classify cryptocurrencies into “coins” and “tokens.” Coins aim to compete with money. For cryptocurrencies such as bitcoin and litecoin, hypothetically the goal is to use them to buy something, a car or house or cup of coffee, depending on the transaction fees. So you could use an app to send two “coins” to a dealership to buy a car.

On the other hand, we have tokens, which, unlike a general currency, serve a very specific purpose. They’re created using blockchain technology and work when you need a native medium of exchange on a platform to do transactions — for instance, allowing someone to store data on your storage system or using decentralized Wi-Fi to connect your smart devices. The reason we have so many tokens is because they try to provide different services to people.

Are all of them necessary? In my opinion, no. Many could be scams or copycats; many aren’t useful and go away in a few months or years.

-

How do you think cryptocurrency and the normal dollar can co-exist? When can I expect to start to use crypto to buy my groceries? — Jose Blanco ’04

People have different views on this, and it’s difficult to predict. Some think bitcoin will never compete with the dollar. It’s very secure, but at the same time it uses a lot of electricity and it’s inefficient. For example, the transaction fees to buy a cup of coffee may be more expensive than the coffee. If you want to move millions of dollars outside China or Venezuela, for instance, it’s probably worth it, but not to buy groceries, at least not today.

-

What are the risk factors? — John Viscoglosi ’84

First, there’s high volatility. With bitcoin, for instance, the price can change a lot on a daily basis. There’s also the threat of hacking and cybertheft. Fraud and market manipulation are concerns, as are developments such as the recent bankruptcy of the crypto exchange FTX. There’s a regulatory risk — a lack of screening and an uncertainty about the future regulatory environment. And it’s a young technology, so there’s uncertainty about the adoption. Better alternatives may emerge in the future.

-

Since cryptocurrency is decentralized and unregulated, what ensures you will have access to your money? If the government does regulate and potentially tax, does crypto lose its allure? — Joseph Carkido ’13

Technologically it’s impossible to ban someone from using, say, bitcoin. Governments can make it more difficult, by censoring the internet or putting someone in jail and restricting access to computers, but technologically it’s almost impossible. And you can’t take someone’s cryptocurrency. As long as a person has their private key, nobody else can access a person’s cryptocurrency.

Can governments regulate it? They already do. We have a crypto exchange in the U.S. called Coinbase. It’s one of the largest around the world and that’s a regulated exchange. If you want to trade on Coinbase, like buy or sell bitcoin or convert different cryptocurrencies, the exchange has to report your Social Security number to the IRS.

-

Is crypto here to stay or just a passing fad? — James Collett ’08

In my class, I talk about the technology, the applications, the scams and fraud, the hype around cryptocurrencies, but then I show a graph from the dot-com bubble of 1999 to the early 2000s. It shows how the Nasdaq index went through the roof and over the next few years a lot of companies went bankrupt. There was a lot of hype, fraud and manipulation, but after the dust settled, we had companies like Google, Adobe and Amazon coming out of the wave.

That’s what I think is going to happen with cryptocurrency. It’s still early, we still have a lot of hype, scams, manipulation. But blockchain technology isn’t going away, and I think some of these platforms are going to stay and be part of the financial system of the future.

-

How and why is there “mining” of coins? How is it done and why does it need done? — Stephen Sierawski ’96, ’99 MBA

At a high level, blockchain technology that allows us to store information decentrally depends on people working on the system, and having incentives to work on the system, to keep it safe and secure in a decentralized manner. Those people are miners.

After someone initiates, say, a bitcoin transaction, the transaction goes into a pool of uncomfirmed transactions. Then miners all around the world look at these transactions, choose a subset of them and start solving a very difficult puzzle in order to verify the transactions. It’s kind of like trying to guess the combination of a lock. The first miner who solves for the combination gets to add their block of transaction (and gets rewarded with cryptocurrency). So those transactions are confirmed and now part of the blockchain.

Because of the way the puzzle is designed, this mechanism keeps it safe and secure and the whole system unhackable. It’s almost impossible to manipulate it.

The cost is lots of electricity devoted to the bitcoin blockchain, but the benefit is it makes the decentralized system work.